Little Known Questions About Clark Wealth Partners.

The Clark Wealth Partners Ideas

Table of ContentsThe 20-Second Trick For Clark Wealth PartnersA Biased View of Clark Wealth PartnersSee This Report on Clark Wealth PartnersGetting My Clark Wealth Partners To WorkClark Wealth Partners Things To Know Before You Get ThisThe Facts About Clark Wealth Partners UncoveredSome Known Incorrect Statements About Clark Wealth Partners More About Clark Wealth Partners

There's no solitary course to ending up being one, with some people starting in banking or insurance, while others start in bookkeeping. A four-year level supplies a solid structure for professions in investments, budgeting, and client solutions.Many ambitious organizers invest one to 3 years constructing these useful abilities. The test is supplied three times yearly and covers locations such as tax obligation, retirement, and estate planning.

Typical instances consist of the FINRA Collection 7 and Collection 65 examinations for safeties, or a state-issued insurance coverage certificate for offering life or health insurance coverage. While qualifications may not be legally required for all planning roles, employers and customers usually view them as a criteria of expertise. We consider optional qualifications in the following area.

The 8-Minute Rule for Clark Wealth Partners

Many monetary organizers have 1-3 years of experience and familiarity with financial products, compliance requirements, and straight customer communication. A solid academic history is necessary, but experience demonstrates the capacity to use concept in real-world settings. Some programs incorporate both, enabling you to complete coursework while earning monitored hours through teaching fellowships and practicums.

Early years can bring lengthy hours, stress to build a client base, and the requirement to constantly confirm your expertise. Financial coordinators appreciate the chance to work very closely with customers, overview crucial life decisions, and often attain flexibility in routines or self-employment.

The Definitive Guide to Clark Wealth Partners

To become a financial coordinator, you generally need a bachelor's level in financing, business economics, business, or a relevant topic and numerous years of relevant experience. Licenses might be called for to offer securities or insurance, while accreditations like the CFP boost reputation and job possibilities.

Optional qualifications, such as the CFP, normally require added coursework and testing, which can prolong the timeline by a number of years. According to the Bureau of Labor Stats, personal monetary experts earn a mean yearly yearly wage of $102,140, with top earners making over $239,000.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

will certainly retire over the next years. To fill their shoes, the country will need more than 100,000 new economic consultants to enter the market. In their day-to-day job, financial advisors handle both technical and creative tasks. United State Information and Globe Record ranked the function amongst the leading 20 Best Organization Jobs.

Aiding people achieve their financial objectives is a financial expert's key feature. However they are additionally a small company owner, and a part of their time is committed to handling their branch workplace. As the leader of their technique, Edward Jones monetary advisors require the leadership skills to hire and manage team, along with business acumen to create and carry out an organization method.

4 Easy Facts About Clark Wealth Partners Explained

Continuing education is a required part of keeping a monetary advisor certificate browse around this web-site - https://www.twitch.tv/clrkwlthprtnr/about. Edward Jones financial consultants are motivated to seek added training to broaden their expertise and skills. Dedication to education and learning protected Edward Jones the No. 17 area on the 2024 Training peak Honors checklist by Training magazine. It's likewise a good idea for economic consultants to attend sector meetings.

That indicates every Edward Jones affiliate is complimentary to focus 100% on the customer's benefits. Our collaboration framework is joint, not competitive. Edward Jones financial consultants take pleasure in the support and camaraderie of other economic advisors in their region. Our monetary advisors are motivated to use and get support from their peers.

How Clark Wealth Partners can Save You Time, Stress, and Money.

2024 Lot Of Money 100 Ideal Companies to Benefit, published April 2024, research study by Great Places to Function, data since August 2023. Payment offered making use of, not getting, the rating.

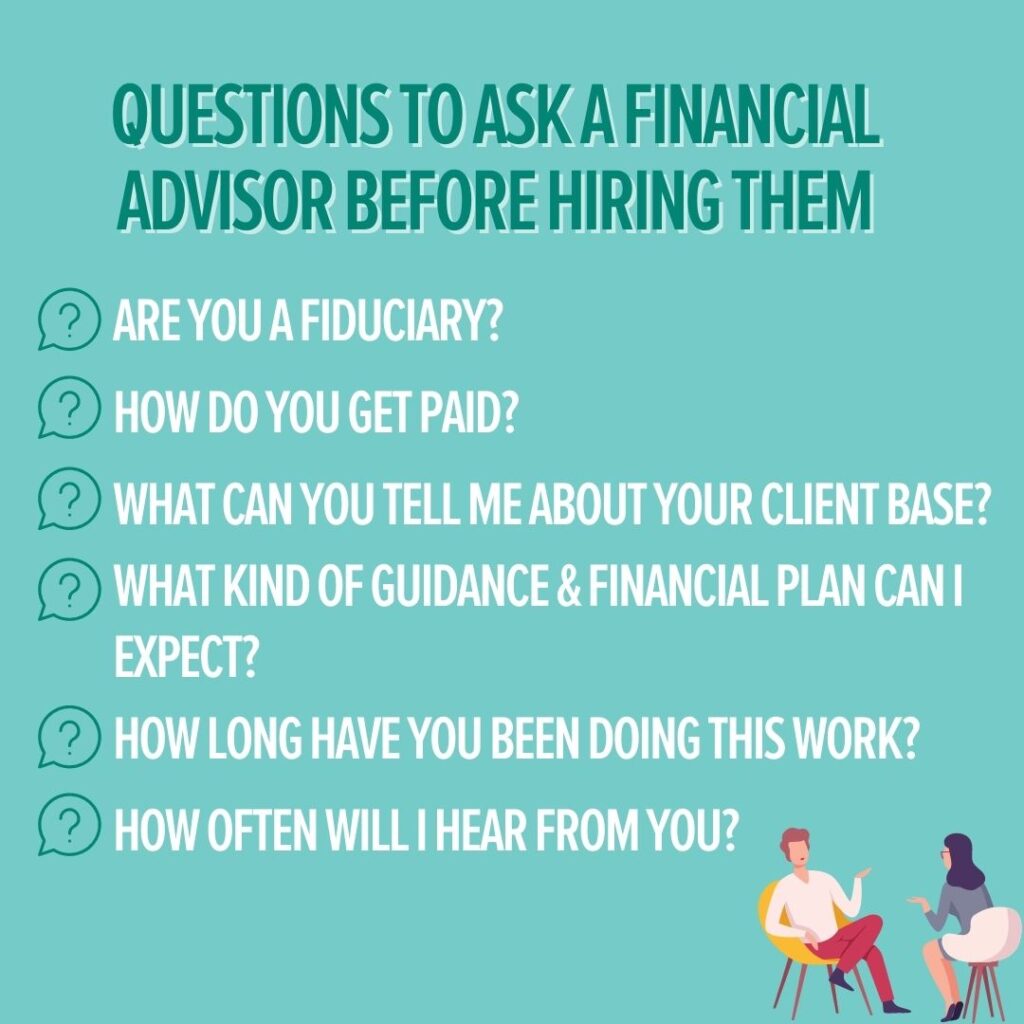

When you need aid in your financial life, there are numerous specialists you might seek advice from. Fiduciaries and economic consultants are two of them (financial company st louis). A fiduciary is a specialist who manages cash or residential property for various other events and has a lawful obligation to act only in their customer's benefits

Financial consultants should arrange time each week to meet brand-new individuals and catch up with the people in their ball. The monetary services market is greatly regulated, and laws transform commonly. Many independent monetary consultants spend one to two hours a day on conformity activities. Edward Jones financial advisors are fortunate the home workplace does the heavy lifting for them.

The 8-Second Trick For Clark Wealth Partners

Proceeding education is a required component of maintaining a financial expert certificate. Edward Jones economic consultants are urged to pursue additional training to widen their knowledge and abilities. Commitment to education and learning safeguarded Edward Jones the No. 17 place on the 2024 Educating peak Honors list by Training magazine. It's likewise an excellent concept for financial experts to attend market conferences.

That indicates every Edward Jones affiliate is totally free to focus 100% on the client's benefits. Our partnership structure is collective, not affordable. Edward Jones financial consultants appreciate the assistance and friendship of various other financial consultants in their region. Our monetary advisors are urged to offer and receive assistance from their peers.

2024 Ton Of Money 100 Best Firms to Help, published April 2024, study by Great Places to Function, data since August 2023. Compensation attended to utilizing, not obtaining, the ranking.

Clark Wealth Partners Things To Know Before You Get This

When you need aid in your financial life, there are several experts you might look for advice from. Fiduciaries and economic advisors are 2 of them. A fiduciary is an expert who manages money or property for other celebrations and has a legal task to act only in their customer's finest interests.